More

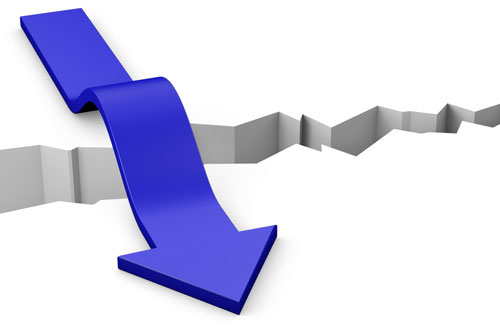

However, sooner or later, the financial bubble will burst. When and how the turnaround will come is impossible to predict. The shift is triggered by some unforeseen event--big or small--that creates uncertainty about the real value of the asset. When the financial bubble bursts, the price of the asset will decrease in a rapid downward spiral. The financiers are no longer willing to provide capital for investments and, instead, demand repayments. Investors now sell their assets in a panic, trying to cut their losses and repay any debts. As the price falls, there are more and more sellers and less buyers, which in turn increases the downward spiral. If an investor has borrowed against the investment and assets were used as collateral, the lender may force a sale -– even at a loss. But at a certain price level and time, the decline of the price stops. New investors begin to believe that the asset is undervalued. This is the time to buy; the price slowly increases and is normalized

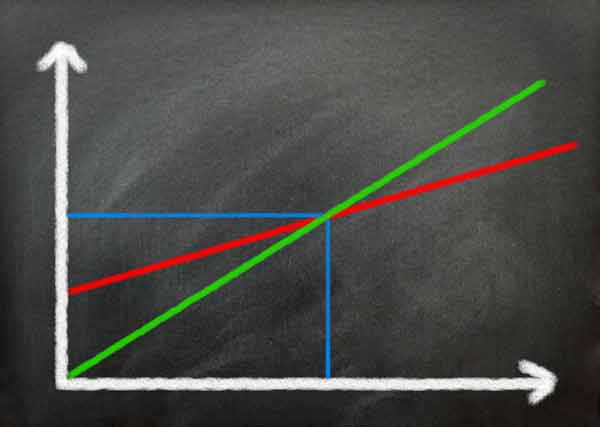

The winners in the bubble are those who bought early at a low price and sold at a high price, just before the bubble burst. The losers are those investors who came in late. They paid a high price and did not have time to sell, or did not want to sell, before the downturn began. Late investors usually wait too long to sell; they hope the price will turn so they can avoid or reduce their loss.

How can you recognize a bubble? It's probably impossible to understand if a rapid price increase in an asset is based on an underlying real value growth or if it's a speculative bubble. You should be careful and observant if the price of an asset rises suddenly and quickly without an apparent change in the asset's real return.

What then are the consequences of a financial bubble? If the bubble involves only a particular asset, such as shares in a small company, the economy in general is largely unaffected. But if the bubble covers the entire stock market or significant and large companies, the burst can lead to a stock market crash and a recession for an entire country. The financial bubble will then impact the real economy, and the effects are extensive.

There have been a number of famous bubbles throughout history. One very well-known bubble was the tulip bubble in Holland (1630). Speculation in tulip bulbs drove values to extremes. During the bubble of the South Sea Company in England (1720), there was speculation in the stock of the South Sea Company, which was trading in the South Sea and other parts of America. The stock exchange crash in the US (October 1929), also known as Black Tuesday, was the most disastrous stock market crash in the history of the United States so far. It led to the Great Depression, which spread to all Western industrialized countries. Black Monday refers to Monday, October 19, 1987, when stock markets around the world crashed after a huge share price increase in a very short time. The IT crash (March 2000), or the dot.com bubble had to do with speculation in assets related to IT and the Internet. The financial crisis of 2008 (September 2008) refers to speculation in various assets, e.g., the housing market, real estate, and subprime mortgages. It led to the loss of confidence in banks, finical institutions, and to the bankruptcy of the Lehman Brothers.