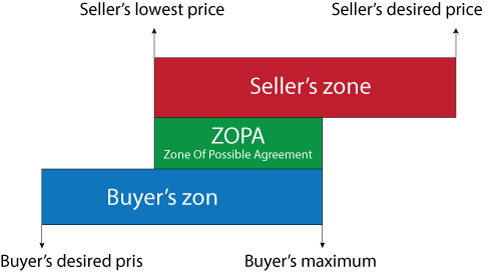

More

Example: Assume that you want to sell your business and think that it is worth €100M – €150M. A buyer is prepared to pay €80M – 120M. Here there is a positive ZOPA. Another buyer is prepared to pay a maximum of €95M. If that buyer is not willing to move into the area of €100M - €150M, or you are not willing to change the lower boundary from €100M to €95M, there is no ZOPA. A soft factor in your ZOPA may be that, in addition to the price, you will insist that regard has to be taken to the employees in the company and that the offices and production must therefore not be moved from its existing location.

Understanding and analysis of the parties' ZOPAs can of course be used in different types of negotiations -- not just in business transactions. And if there are more than two parties, the analysis, understanding and acceptance of the various parties' ZOPAs is even more complicated.

An alternative way of expressing "ZOPA" is to say that it is necessary to understand and accept the counterparty's agenda in order to be able to reach an agreement.